Q4 2022 Economic Commentary

Nearing the end?

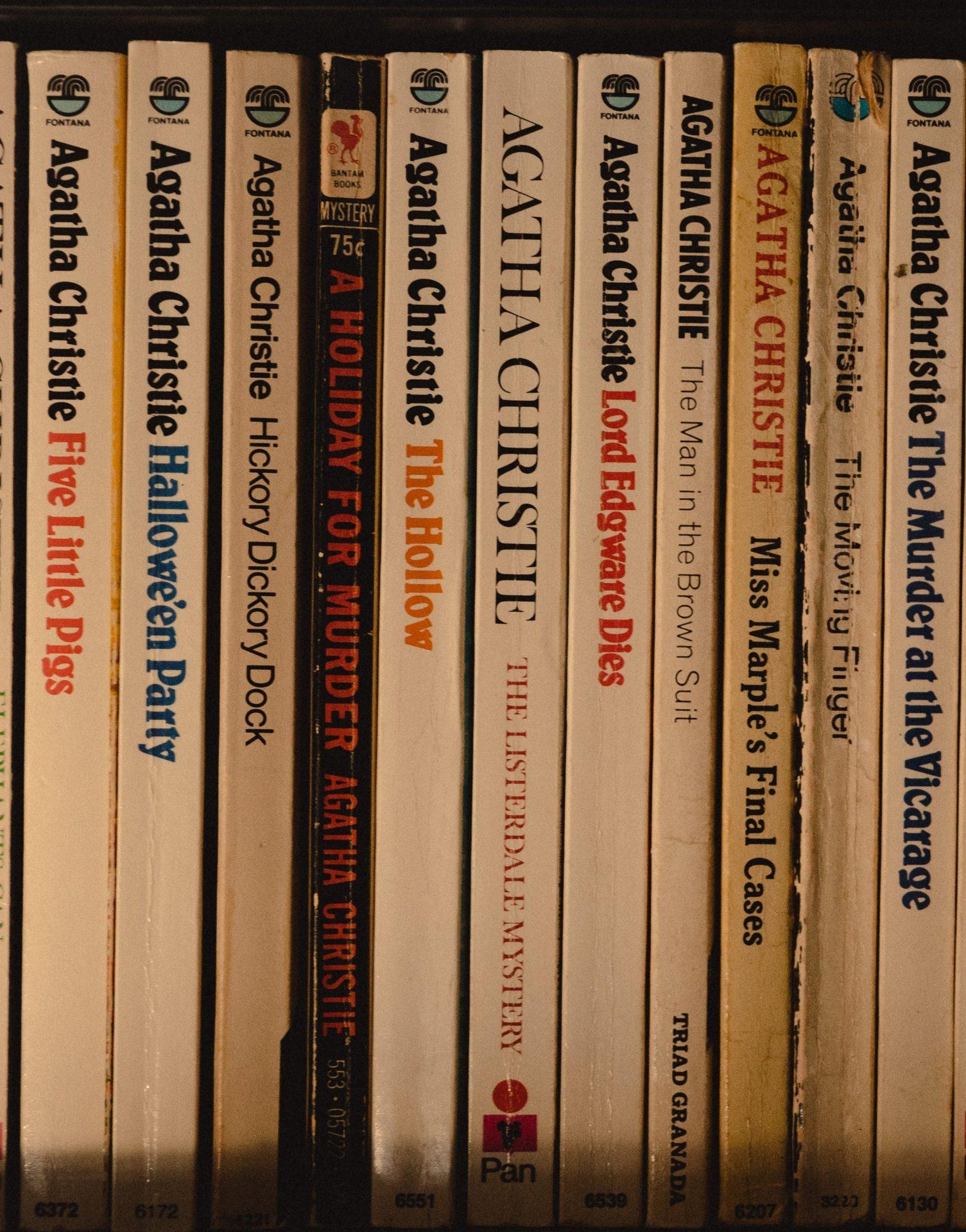

2022 has had more economic and political twists and turns than an Agatha Christie novel. However, the defining act of the year, for asset markets, has been central banks ‘renormalising’ the cost of money, which has caused a repricing of assets. Not only have the central bankers raised interest rates across the globe, but they have implemented the monetary tightening at a

rapid rate, generating asset market volatility.

If economists’ consensus estimates are to be believed we are nearing the end of this rising rate period and moving to a ‘pause and see’ phase, before reducing interest rates towards the end of 2023. As Federal Reserve (Fed) Chair Jerome Powell affirms much will depend on the path of inflation and the geo-political situation in the months ahead. “We will stay the course until the job is done,” Powell told reporters after the last Fed policy meeting.

There is still considerable uncertainty as to the path ahead for inflation, particularly if wage pressures remain.