Q1 2024 Economic Commentary

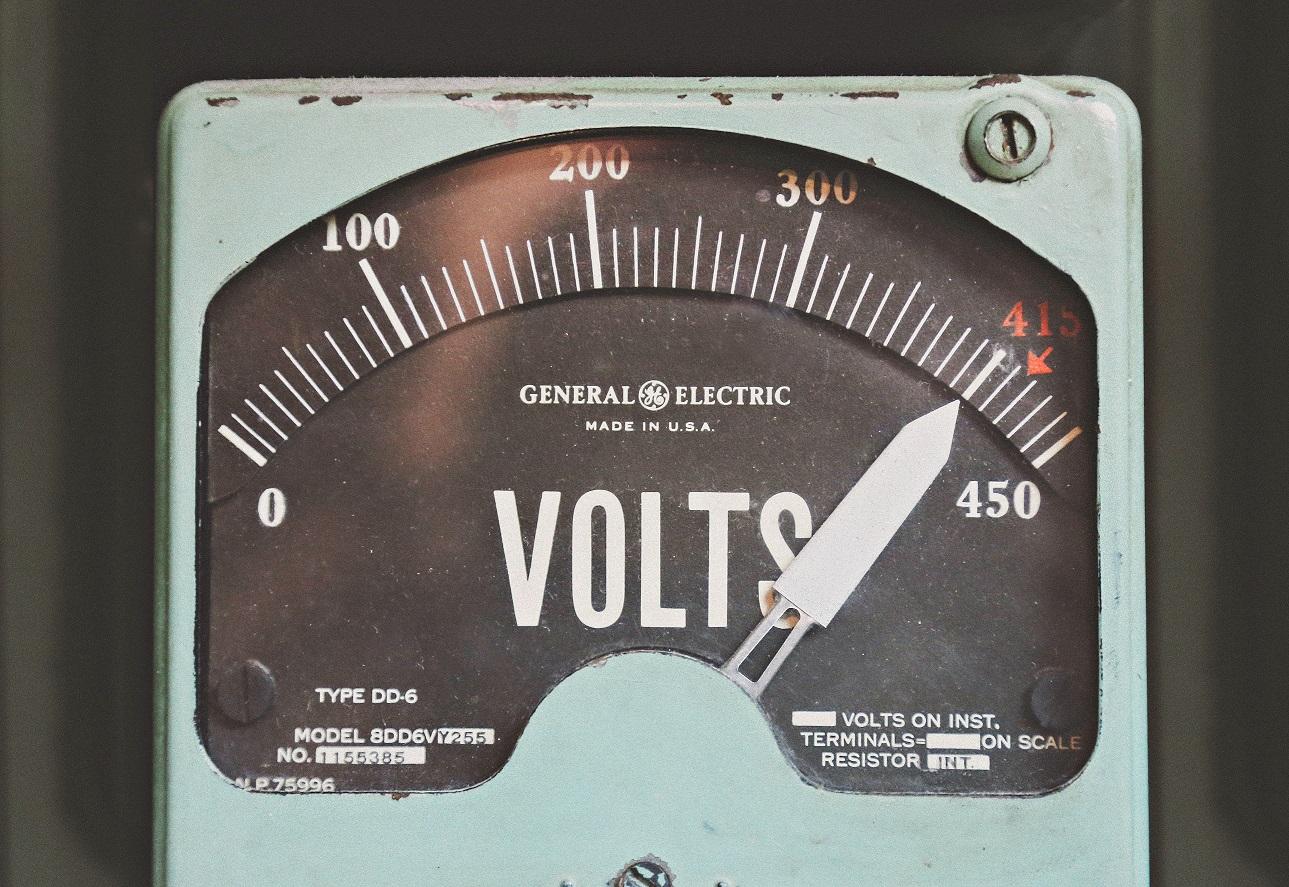

Powering up

Equity markets have enjoyed a robust start to 2024, continuing the trend that started in the fourth quarter of 2023 even as one of the main contributors of that optimism, the markets expectation of interest rate cuts, diminished in strength and timing.

The markets unhealthy infatuation with slight policy changes in central banks language has led to government bond volatility over the past 5 months. In January government bond markets were pricing in almost seven interest rate cuts by the US Federal Reserve (Fed) and the Bank of England (BoE) with six expected by the European Central Bank (ECB) in 2024. Through the latest quarter market expectations of rate cuts have reduced, as it became clear that expectations were too optimistic on the decline of inflation, and too pessimistic on economic growth. Consequently, government bond yields have partially retraced their fall from the moment the Fed changed its language in November last year to early January.